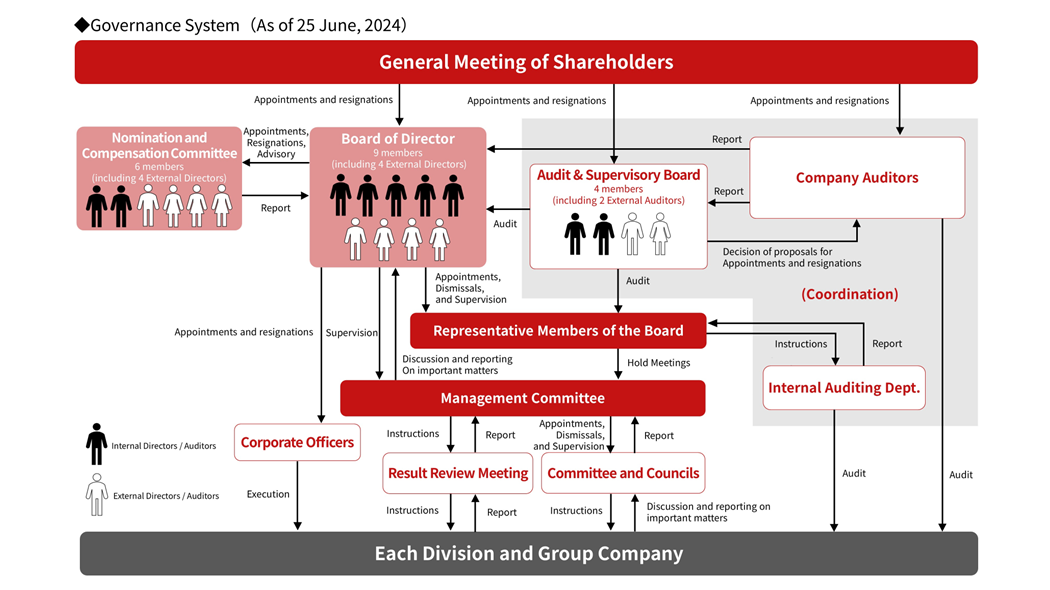

Governance Structure

To continue sound business activities, we are developing systems for further improving governance.

Basic Stance on Corporate Governance

We aim to maintain sound management and increase corporate value from the medium- to long-term perspective by developing management organizational structures and mechanisms and implementing the necessary measures.

To achieve this, we have adopted the following five basic policies.

Basic Policies for Corporate Governance

-

We ensure the rights and equality of our shareholders and strive to create an environment in which they can exercise their rights appropriately.

-

We work to sustain good relationships by fulfilling our responsibility as a company to stakeholders, such as our shareholders, customers, partners, local communities, and employees.

-

We appropriately conduct disclosure based on the law while also independently striving to provide information other than that required by law.

-

The Board of Directors will intensively deliberate on agenda items, determine the supreme management policy, and supervise business management trends based on each member's knowledge and experience underpinned by a thorough understanding of the business. In addition, the Board will actively discuss management issues derived from the agenda items in order to fulfill its appropriate roles and responsibilities.

-

We will endeavor to engage in constructive dialog with shareholders, and strive to disseminate and share information by providing feedback to management and members of the Board on the opinions and other information collected through such dialog.

Skill matrix

The abilities and experience of Members of the Board and Audit & Supervisory Board Members of the Company in relation to the skills required for the Company to achieve its 2026 Medium-term Management Plan and to contribute to a sustainable society by supplying “indispensable key parts” are as follows:

Note: The following table does not represent all the knowledge possessed by Members of the Board and Audit & Supervisory Board Members.

Of the expected skills in the following table, a “〇” indicates a skill associated with each candidate’s background and a “◎” indicates a skill that is highly expected to be demonstrated by the candidate.

The expected skills for the Members of the Board and Audit & Supervisory Board Members are reviewed according to changes in the business environment and management policies.

Click on image to enlarge